Break down the silo mentality, make use of your company data and share your priorities with your suppliers.

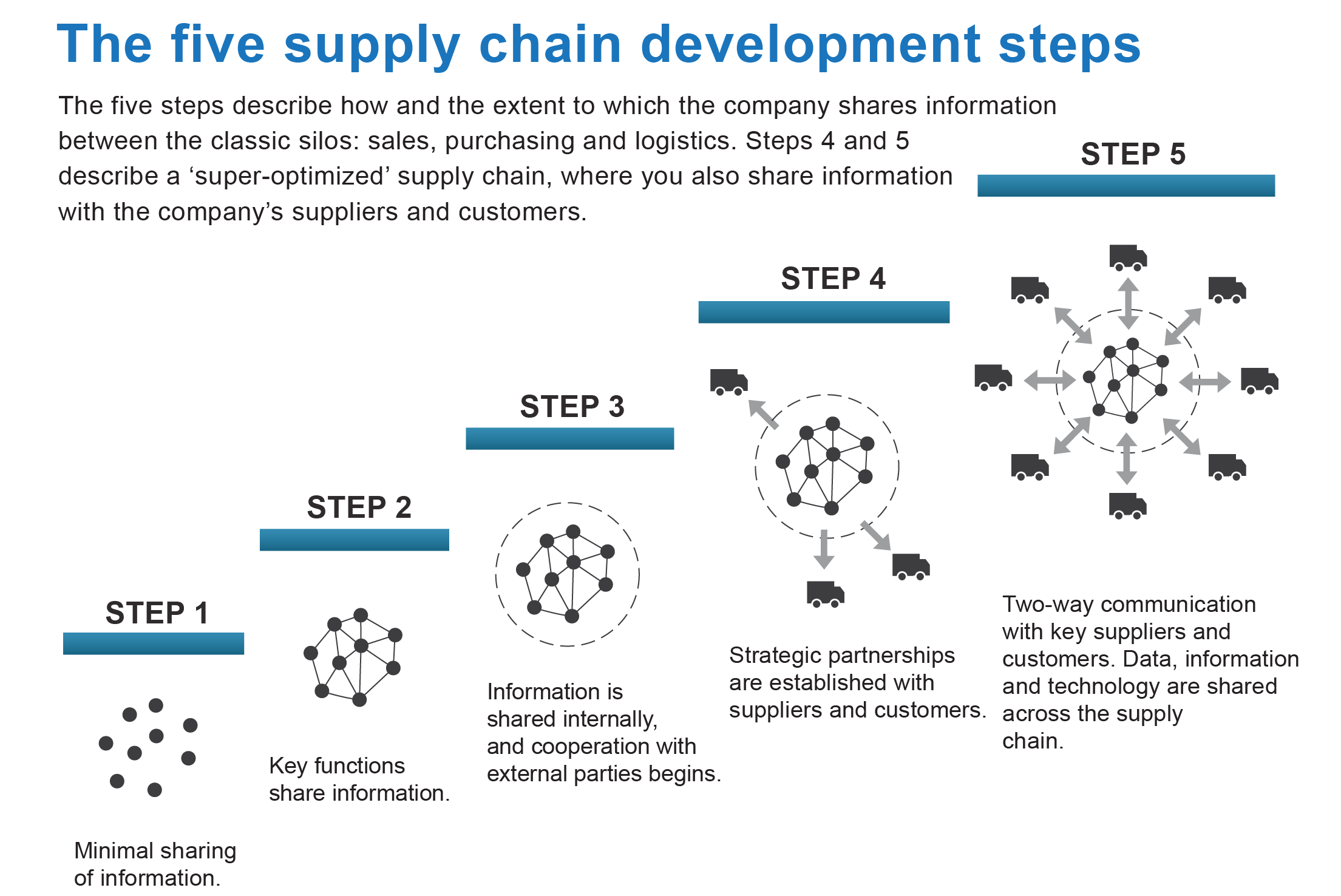

Most companies dream of optimizing their supply chain, and aim to minimize stock without compromising security of supply. Troels Kyhn Jakobsen, ABC Softwork, explains in five steps the road towards a ‘super-optimized supply chain’, where you work closely with suppliers and customers. Many Danish companies never make it beyond Step 2 as they lack the tools to proceed further up the latter.

“When data and communication are in place, supplier negotiations and cooperation shift to a completely new level, first internally and then vis-à-vis the supplier,” says Troels Kyhn Jakobsen, adding: “You can quickly respond to market changes if your supply chain is transparent.”

Troels Kyhn Jakobsen, senior implementation consultant at ABC Softwork, has worked with Danish companies who want to strengthen their supply chain. Troels has developed a five-step model based on both theory and practice, which shows the steps a typical business goes through when optimizing its supply chain. He uses this model to identify the potential of the entire supply chain for each company.

The process can take several years. In the first steps, the company has limited internal cooperation and prioritizes everyday tasks according to gut feeling and existing habits. Many companies have made it slightly further, but they all have the potential to gradually develop to Step 5: A truly optimized supply chain with close cooperation and full transparency between supplier and customer.

Step 1: Each department conducts its own optimization processes.

Sales, purchasing and logistics operate independently and try to optimize their own parameters without taking account of what is important for the other departments.

Sales focus on high margins and security of supply, always and for all customers.

This contrasts with the purchasers’ number one priority: To balance inventory and service levels. Often purchasing will be under pressure from sales to negotiate large discounts against taking large volumes. This results in a lot of ‘dead’ stock every time the sales prognoses fail to hold water.

Companies on Step 1 trade on gut feelings rather than (mathematical) facts. This type of decision making doesn’t help you much when disruptive changes hit your market.

“I met a company which sat on 80% of its market without significant competition. While they enjoyed everyday life, major changes churned ahead. Suddenly, several foreign suppliers started to encroach on their market, and the company was unable to adapt.

Due to their static work routines, habits and behaviour they hit a dead end. They did not have the organisational structure nor the sufficient data to restructure their supply chain, and lost their lucrative market position in no time.”

In this phase, the organization fails to acknowledge that it is necessary to change. Troels continues:

“People lack the tools to move forward. They look at the data and think there is something that isn’t quite right. But it is too complex to grasp. “Where should I begin?”

So, what do you do?

Step 2: Recognize the problem, even though it hurts

Senior management must acknowledge that finances, purchasing, sales and logistics have to come together and find ways to tear down the silo-mentality, and eliminate counter-productive KPIs within the different departments. Step one is to define basic principles for purchasing, along with a shared language and shared priorities across the different departments.

Afterwards sales can count on that the most important products (for the company as a whole) are in stock. And sales knows that the high level of service given to these special products cannot be expected for less important ones.

In Step 1, many decisions are made on an uncertain basis, which has curbed the company’s development. In Step 2, the company acquires a common language for which products it needs to have in stock. The ‘language’ is a product categorization, which showcases each product’s importance for the business.

Troels Kyhn Jakobsen finds that the analysis creates a ‘burning platform’ which fuels a willingness to change:

“People don’t like it when they’re told that one of the products they are responsible for is low-priority. Then they start counterarguing. But if they’re presented with mathematical facts that more or less speak for themselves, it has a convincing effect and form a starting point for changes in behavior.”

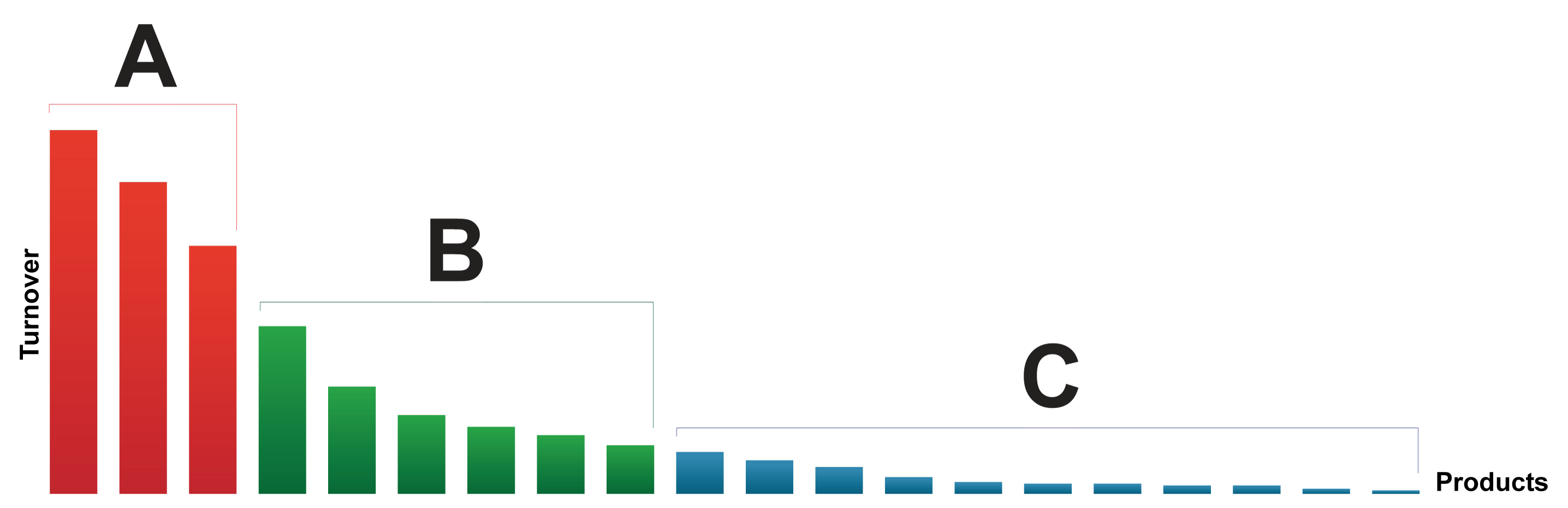

A company usually finds that 20% of the products account for 80% of turnover – and vice versa: That 80% of the products account for only 20% of turnover.

First time sales and purchasing see which products account for 20% of the turnover, the new insight creates a common agenda throughout the value chain in the company, and questions such as “Why is this product not in stock?” are no longer asked.

Step 3: Involve suppliers

Once the company has analysed the situation and derived at a list of priorities, it is a question of negotiating with its suppliers so that the terms of delivery reflect the company’s own priorities.

When a company employs data-based decision-making and shares the information with its suppliers, the company can negotiate terms of delivery which support its priorities faster.

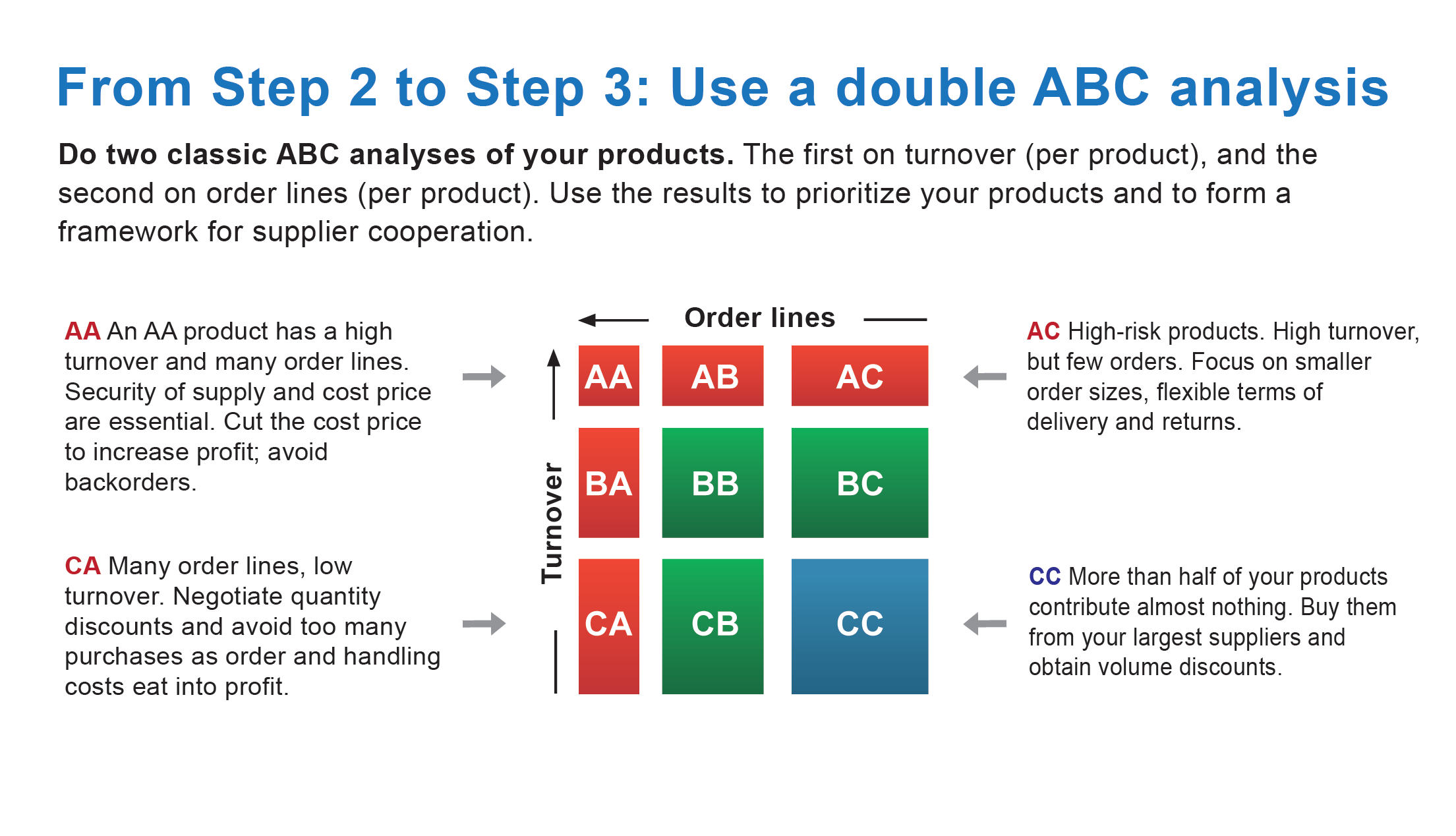

The double ABC analysis (see illustration) is the key that unlocks the needed insights. Troels Kyhn Jakobsen emphasizes:

“You need to have your own priorities in place before you demand anything of your suppliers. It is impossible to optimize earnings if you don’t know which products are important to you, – and why.”

Troels mentions an ABC Softwork customer who took an unusual step:

“Our customer made a special agreement with one of their most important suppliers. The supplier’s main warehouse is situated less than 1 km from the customer’s, so the customer simply shifted their buffer stocks to the supplier. This released DKK 500,000 from the customer’s stocks.”

Step 4: Key suppliers receive special treatment

The suppliers’ portfolio can also be refined. This is the next step.

“For many companies, combing their supplier portfolio and renegotiating contracts is a big task. Using the 80/20 rule makes the task more manageable. With the right tools, people in the purchasing department can easily identify the 10-20 suppliers who deliver their most important products,” says Troels Kyhn Jakobsen.

This knowledge makes the renegotiations clearer and more motivating, as even small adjustments to the biggest supplier contracts can be seen directly on the bottom line. It is necessary to take a systematic approach by categorizing the products and setting specific targets for each category. (See the illustration on double ABC analysis.)

With good data at hand and openness about the company priorities, it is possible to create close strategic alliances with the most important suppliers.

The following dialog becomes a thing of the past:

Customer: “We want it cheaper!”

Supplier: “Then you have to order more!”

Step 5: Supplier and customer share data

On step 5, the customer and supplier move close together. ABC Softwork has found that some customers write the ABC codes on the order forms, to make sure a supplier knows if a product is high or low priority for them. In this way, the ABC codes become a shared language both internally and externally.

Openness and transparency strengthen the relationship and pave the way for optimum cooperation.

In Step 5, negotiations are based on a mutual interest in developing and strengthening each other’s business. You promote the strengths and reduce the weaknesses in the value chain which both customer and supplier are a part of. This closeness gives the companies a healthy business with stable delivery capacities.

Far from all companies reach this stage. To reach it both the company and its suppliers need to go through a gradual (and long) acknowledgement process which involves both employees and the management team. On top of this, it requires IT investments and resources to implement it.

About ABC Softwork

Troels Kyhn Jakobsen is a supply chain consultant at ABC Softwork, which helps companies to optimize their entire supply chain.

ABC Softwork has developed the analysis tool ‘ABC Analyzer’, which creates simple and clear overviews of a company’s data, especially useful for purchasing and sales. At the heart of the tool is a double ABC analysis of the company’s product range.

Troels helps to implement ABC Analyzer and advises on new work processes to ensure that the company take advantage of the new insight.

ABC Softwork works with Bdr. AO Johansen, Widex, Sanistål and Matas.